In the world of cryptocurrency trading, protecting your investments during market downturns such as the one we just experienced is crucial. That’s why we’re thrilled to introduce another major update to our Recommendations service: the Automatic Trailing Stop-Loss Functionality. This new feature is designed to safeguard your portfolio by dynamically tracking asset prices and triggering sell recommendations when necessary, ensuring you minimize losses while still capitalizing on top-performing coins.

What is a Trailing Stop-Loss?

A trailing stop-loss is an advanced trading tool that helps investors lock in profits and limit losses by automatically adjusting the sell price of an asset as its value changes. Unlike a traditional stop-loss, which is set at a fixed level below the purchase price, a trailing stop-loss moves with the market, following the asset’s peak value. If the asset’s price drops by a certain percentage from its highest point, the trailing stop-loss triggers a sell, protecting you from significant losses.

How Our New Trailing Stop-Loss Feature Works

Until now, our system focused solely on switching out coins that weren’t the absolute top performers. While this approach kept your portfolio aligned with the best options available, it also led to frequent trades, sometimes causing unnecessary swaps of coins that were still performing well.

With the new update, we’ve added a sophisticated asset price tracking system that works in tandem with our trend indicator:

- Continuous Monitoring: After you purchase a coin, its market value is monitored throughout its lifecycle in your portfolio.

- Best Price Tracking: The system remembers the highest price the coin reaches during this period.

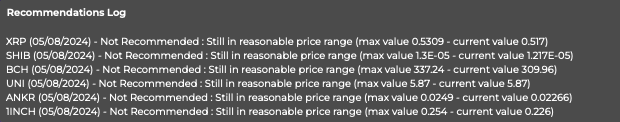

- Sell Trigger: If the coin’s current price falls below 15% of its best price, our system triggers a sell recommendation. This 15% drop rate is our “Max Drop Rate” setting, designed to strike a balance between holding onto a potentially recovering asset and cutting losses before they deepen.

- Trend Indicator Activation: Once the sell recommendation is triggered, our trend indicator then identifies the next best-performing coin(s) for reinvestment, ensuring your portfolio is always optimized for growth.

Benefits of the New Approach

- Reduced Overtrading: By focusing on significant price drops rather than constantly seeking the next best performer, we reduce unnecessary trades, giving each asset more time to perform.

- Enhanced Loss Mitigation: The trailing stop-loss ensures that your portfolio is protected from sudden downturns, minimizing losses while still allowing room for recovery.

- Optimized Performance: After a sell is triggered, our trend indicator seamlessly takes over, ensuring your investments are redirected into the best opportunities available.

What to Expect

With this update, you can expect fewer but more meaningful recommendations, with a stronger emphasis on protecting your assets during volatile market conditions. This new layer of security should lead to more stable and consistent portfolio performance over time.

Share Feedback

As with all significant updates, we’re closely monitoring the performance of this new feature. We encourage you to share any feedback or issues you encounter so we can continue to refine and optimise our service.