Welcome to CryptoCracker! You gave us feedback, and we listened.

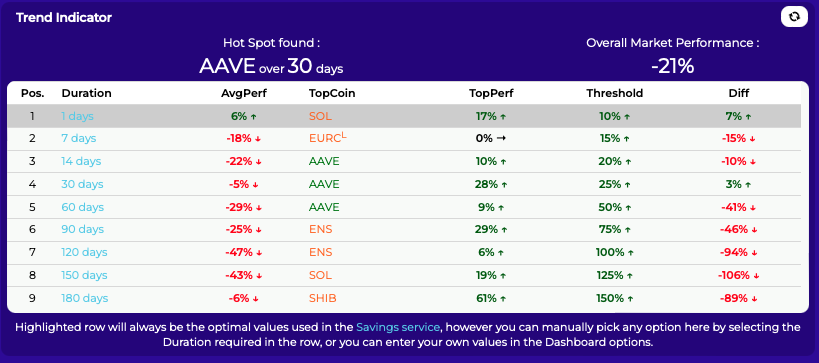

The new Trend Indicator is now live and automatically loads when you log into your CryptoCracker account. It’s got a fresh look and provides the information you need right away. But the changes go much deeper than just the visual updates. We’ve completely reworked how the Trend Indicator analyses data.

Let us explain the changes made to our Trend Indicator. Whether you’re a seasoned trader or just starting out, understanding these changes can help you make better-informed decisions.

The Old Trend Indicator: Multiplier Model

Our original Trend Indicator used a Multiplier model. This model was designed to spot significant movements in cryptocurrency performance. Here’s how it worked:

- Multiplier Concept: The model focused on relative performance increases. For instance, if SOL (Solana) showed a 9% increase in one day, compared to an average of 0%, it was seen as a 10x multiplier (since 9% is 10 times more than 0%).

- Sensitivity to Outliers: The model was highly sensitive to outliers – coins with sudden, sharp increases. If a coin showed a big spike, it would quickly catch the Indicator’s attention.

- Short-Term Gains: While this approach helped spot coins with rapid gains, it often led to short-lived results. For example, SOL might show a quick spike, but this didn’t always lead to long-term performance.

The New Trend Indicator: Threshold Model

After careful analysis and testing, we’ve upgraded to a Threshold model. Here’s what’s changed:

- Performance thresholds refer to predefined levels of performance that an asset must achieve before being considered in analysis or recommendations. These thresholds are used to filter out assets that do not meet minimum performance criteria, ensuring that only those with sustained, significant performance are highlighted.

- Stable Selection: By setting these thresholds, we aim to pick coins that show consistent performance over time, rather than just sharp, short-term spikes. This helps identify assets likely to perform well in the longer term.

- Configurable Durations: The thresholds are adjustable for different timeframes – 1 day, 7 days, 30 days, and 60 days. For instance, a coin needs to show a certain percentage of performance over these periods to be flagged by the Indicator.

Some Real Examples: SOL, ICP, and ENS

Let’s compare the performances of SOL, ICP, and ENS under both models:

Old Model (Multiplier):

- SOL (1 Day): A 9% increase was flagged due to a 10x multiplier from 0%.

- ICP (7 Days): Although ICP showed a 35% increase over 7 days, it was often overlooked because SOL’s one-day performance was more striking.

New Model (Threshold):

- SOL (1 Day): With a -1% differential under the threshold model, SOL doesn’t make the cut for the 1-day performance.

- ICP (7 Days): With a more stable threshold, ICP’s consistent 35% increase becomes more prominent.

- ENS (Various Durations): ENS, which showed 2% in 1 day, 3% in 7 days, 12% in 30 days, and 82% in 60 days, is highlighted across multiple durations due to its steady upward trend.

Benefits of the New Approach

- Reduced Volatility Sensitivity: The new model reduces the chances of selecting coins based solely on short-term spikes. This leads to more stable and reliable recommendations.

- Longer-Term Focus: By setting performance thresholds, we are now looking at coins that can sustain their growth over longer periods, which benefits both short-term and long-term investors.

- Improved Portfolio Performance: Early results suggest that the new model provides more consistent performance in user portfolios, avoiding the pitfalls of sudden drops after initial gains.

The shift from the Multiplier to the Threshold model in our Trend Indicator is a significant step towards providing you with more stable and reliable crypto trading recommendations. By focusing on consistent performance rather than short-term spikes, we hope to help you make better, more informed trading decisions.

Stay tuned to CryptoCracker for more updates, tips, and insights into the ever-evolving world of cryptocurrency trading!

Happy trading!